A “person with a disability” means any person eighteen (18) years of age or older determined by the court to be in need of partial or full supervision, protection, and assistance by reason of mental illness, physical illness or injury, developmental disability, or other mental or physical incapacity.

The person with a disability is often referred to as the respondent in conservatorships.

A conservator is a person or entity appointed by the Court to provide partial or full supervision, protection and assistance to a respondent. The person may be appointed as conservator over the respondent to manage medical affairs and activities of daily living; conservator of the property to manage the financial affairs of the respondent; or a conservator over the person and property.

A fiduciary is a person who has been legally granted rights and powers to be exercised for the benefit of another person. For example, a personal representative of an estate is a fiduciary; a conservator of a person with a disability is a fiduciary; a guardian of a minor child is a fiduciary; and a trustee of a trust is a fiduciary.

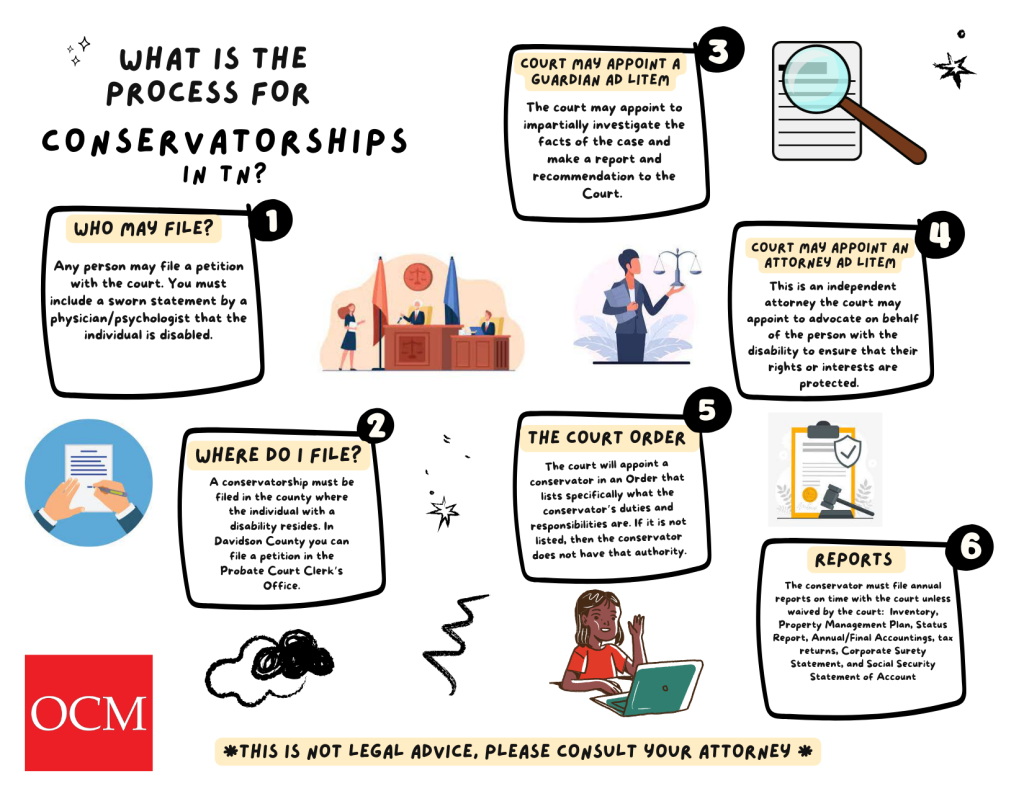

Any person may file a petition for appointment of a conservator if he or she has knowledge of circumstances necessitating a conservatorship. The persons having priority to be conservator, subject always to the Court’s discretion, are: (1) the person(s) designated in writing by the person with the disability designated in writing; (2) the person with the disability’s spouse; (3) any child of the person with the disability; (4) closest relatives of the person with the disability; and (5) other persons.

A conservatorship must be filed in the county where the individual with a disability resides. In Davidson County you can file a petition in the Probate Court Clerk’s Office located on the third floor of the Historic Courthouse in downtown Nashville. In other counties, you can file a petition in any probate court or other court of appropriate jurisdiction in the county of residence of the alleged person with the disability. If filing outside Davidson County, check with the court clerk in the county where you intend to file to confirm which court hears conservatorships. You are strongly advised to hire an attorney to assist you with this process.

Yes. In order to establish a conservatorship, you must prove that an individual is disabled by a clear and convincing legal standard, which is usually accomplished through a sworn statement by a physician, psychologist, or senior psychological examiner.

If the conservatorship is already established the conservator is the one who protects the rights of the respondent. If the conservatorship is being challenged by the individual with a disability, an attorney ad litem (“AAL”) will be appointed to represent the person with a disability upon their request, recommendation of the guardian ad litem or if it appears to the Court to be necessary to protect the rights of the person with a disability.

An attorney ad litem (“AAL”) is an independent attorney the court may appoint to advocate on behalf of the person with the disability. The court shall appoint an attorney ad litem to represent the respondent on the respondent’s request, upon the recommendation of the guardian ad litem or if it appears to the court to be necessary to protect the rights or interests of the respondent. The attorney ad litem shall be an advocate for the respondent in resisting the requested relief.

A guardian ad litem (“GAL”) is a person the court may appoint to impartially investigate the facts of the case and make a report and recommendation to the Court on whether a fiduciary should be appointed and whether the proposed fiduciary is the appropriate person to serve. Unlike the AAL, the GAL does not defend against the requested relief on behalf of the respondent. The guardian ad litem serves as an agent of the court, and is not an advocate for the respondent or any other party.

A conservator may be discharged or have conservatorship duties modified when the Court determines by a preponderance of the evidence that the respondent is no longer disabled or that it is in the respondent’s best interest to do so. The Court may also remove or modify a conservator on grounds the conservator has not performed as required by law or does not act in the respondent’s best interests.

The appointment of a conservator does not automatically terminate a person with the disability’s duty to support a spouse or minor children. The Court may establish the amount of financial support to which a spouse or children are entitled.

Yes. A status report is always required. Other documents such as an inventory, bond, accountings, and a property management plan will be required by the conservator unless the requirement is waived by the judge.

Many of the forms that are necessary to file with the court may be found on the Davidson County Probate Court Clerk’s website: https://circuitclerk.nashville.gov/probate-forms/

An Annual Status report is due six (6) months after the date of your appointment as conservator. An Annual Status report is due twelve (12) months from the date of the first Annual Status Report and every twelve (12) months thereafter. The status report form is a form you can download from the Probate Court Clerk’s website (see above). The conservator is required to include with each status report a statement concerning the physical or mental condition of the respondent, which statement shall demonstrate to the court the need, or lack of need, for the continuation of the fiduciary’s services.

An Interim Annual Accounting is due six (6) months after the date of your appointment as conservator. Annual Accountings are due twelve (12) months from the date of your Interim Annual Accounting and every twelve (12) months thereafter.

The Inventory is due sixty (60) days from the date of your appointment as conservator unless the inventory was separately stated as an inventory in the petition.

The property management is a Court approved budget that tells the Court how the conservator will manage the respondent’s assets, pay for the respondent’s needs, and how the conservator plans on investing any remaining assets. The Inventory is a complete list of the respondent’s personal property, real property, and income. The inventory tells the Court all that the respondent possesses.

Contact your attorney if you need assistance with your accounting. OCM Educational Materials may be found on the OCM website: http://ocm.nashville.gov/ or on YouTube and should greatly assist in properly fulfilling your fiduciary duties. There is also a sample accounting packet on our website you may use as a guide.

A (conservator) surety bond provides financial compensation to the conservatorship estate should the conservator fail to properly exercise their financial fiduciary duty. A bail bond is used to release a person who has been arrested on a criminal matter from jail.

The Annual Status Report can be found at https://circuitclerk.nashville.gov/conservatorship-annual-status-report/ (1) mailed to the Probate Court Clerk’s Office, P.O. Box 196300, Nashville, TN, 37219-6300; (2) faxed 615-296-4502; (3) efiled https://circuitclerk.nashville.gov/eFile/ or (4) you can visit the Clerk’s Office in the Historic Metro Courthouse located at 1 Public Square, Suite 303, Nashville, TN 37201.

Conservator for Person: File the Death Certificate with the Probate Court Clerk’s Office. Submit a note with the filing to request an Order to close the conservatorship. If there is an attorney of record, ask them to submit an order to close the conservatorship.

Conservator for Property: File the Death Certificate with the Probate Court Clerk’s Office. Submit the Final Accounting showing a balance of zero. Submit a note with the filing to request an Order to close the conservatorship. If there is an attorney of record ask them to submit an order to close the conservatorship.

The TN Center for Decision Making Support has resources. Also, consult with a lawyer that provides conservatorship representations.

- Consult with a lawyer for advice.

- QIT Steps

- Draft QIT

- Select trustee

- Calculate what income is going into the QIT and complete Schedule A to reflect the income

- Go to bank and open QIT account using SSN of beneficiary

- Once funded, set up automatic ACH payments to the facility so that the QIT empties each month